News

News

News

News

News

News

Blogs

Blogs

India’s festive season is here! It’s a time for joy and cherished moments with loved ones, but in today’s digital landscape, this period also attracts financial fraudsters eager to exploit our excitement.

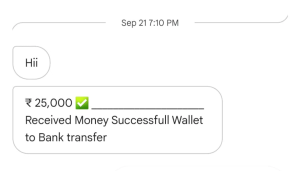

Over the last few years, India’s digital payments landscape has seen remarkable growth. However, this surge comes with alarming risks; recent data reveals that digital payment fraud skyrocketed to INR 14.57 billion by March 2024!

As you gear up for holiday shopping, it’s crucial to stay vigilant against scams that could lead to financial loss. In this blog, we’ll highlight common types of fraud and share practical tips to help safeguard your finances this festive season. Let’s dive in!

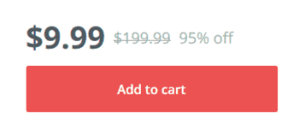

Understanding the most prevalent scams can help you protect yourself and your finances. Here are the most common scams in India:

To protect yourself from financial fraud, it’s crucial to be aware of common warning signs such as:

Recent innovations are transforming cross-border payments, making them faster, cheaper, and more efficient. Here are a few notable advancements:

The festive season in India should be filled with joy, not overshadowed by the threat of financial fraud. By equipping yourself with knowledge about the latest scams and adopting security practices, you can safeguard your finances and those of your loved ones.

While technology makes our lives easier, it also demands greater awareness. Let’s pledge to remain vigilant and practice responsible online behavior today and always!

Blogs

Blogs

India’s digital payments landscape is not only rapidly expanding but also setting benchmarks globally. According to a report by the Reserve Bank of India (RBI), India accounts for nearly half of the world’s digital payments, holding a 48.5 percent share in global real-time payment volumes. This immense volume of transactions highlights the critical importance of adherence to payment compliance standards. For businesses operating within this space, ensuring compliance is not just a regulatory necessity but a key factor in maintaining operational integrity and fostering trust.

In this guide, we will cover the essentials of payment compliance in India and the importance of staying updated with industry trends.

In India, the payment industry is governed by several key regulations and bodies:

In addition to this, other requirements include compliance with Know Your Customer (KYC) norms, data localization, Payment Card Industry Data Security Standard (PCI DSS), and Goods and Service Tax (GST). Adhering to these standards not only ensures legal compliance but also enhances security, operational stability, and market credibility.

AML regulations are fundamental to maintaining the integrity of financial systems. In India, this compliance aims to prevent financial crimes such as money laundering and terrorism funding. Financial institutions and payment service providers are required to implement their frameworks, such as KYC procedures.

Regular training for staff on AML regulations and the use of advanced analytics tools to detect unusual patterns are also crucial. By adhering to these guidelines, providers enhance their reputation for security and reliability in their operations.

UPI has changed the way payments are made in India with its seamless, real-time transaction capabilities. UPI has recently been adopted in different countries too! Managed by the NPCI, UPI must adhere to NPCI’s guidelines to ensure smooth and secure transactions.

Some key compliance aspects include adhering to prescribed transaction limits, implementing story encryption and security measures, ensuring compatibility across different banks and financial institutions, etc.

NPCI also emphasizes user content and transparency, ensuring that users are fully informed about transaction details and terms.

Card payments are a significant component of the digital payment ecosystem. Compliance with the RBI is essential for card issuance and acceptance.

Key regulatory requirements include following issuer guidelines for cardholder verification including KYC procedures, implementing secure technologies such as EMV (Europay, MasterCard, and Visa) chips and tokenization, establishing clear processes for resolving disputes, etc.

Additionally, regular audits and updates to security protocols are vital to meet evolving standards and protect against potential vulnerabilities.

Digital wallets have gained immense popularity for their convenience and ease of use. However, wallet service providers must comply with RBI guidelines to operate legally and securely.

Essential compliances include KYC, adhering to transaction limits, implementing stringent measures to protect user data and adopting a proactive approach to regulatory changes and technological advancements.

For businesses operating in the digital payments sector, staying current with regulatory changes and industry trends is essential for maintaining compliance. Actively engaging with industry forums, regulatory bodies, and technology providers ensures that companies can swiftly adapt to new developments and challenges.

In India’s robust digital payments environment, it is important to navigate the compliance landscape with both diligence and flexibility. Adhering to established standards helps protect sensitive information and preserves the integrity of financial transactions, which in turn fosters trust and stability within the financial system.

Here’s to a safe and secure India!