Blogs

Blogs

Role of NPCI In Transforming India’s Payment Landscape

In the bustling streets of India, a vegetable vendor effortlessly accepts digital payments from customers using their smartphones. This seamless transaction is a testament to the transformative power of the National Payments Corporation of India (NPCI), which has revolutionized the country’s payment landscape.

About NPCI

Established in 2008, NPCI is a not-for-profit organization dedicated to creating robust payment and settlement infrastructure in India. Its mission is to provide secure, efficient, and accessible payment solutions, fostering financial inclusion and a cashless economy.

Growth and Development

Over the years, NPCI has introduced several innovative payment systems:

Unified Payments Interface (UPI): Launched in 2016, UPI has become a cornerstone of digital payments in India. In December 2024, UPI recorded a staggering 16.73 billion transactions, an 8% increase from the previous month, with a transaction value rising to ₹23.25 lakh crore Economic Times

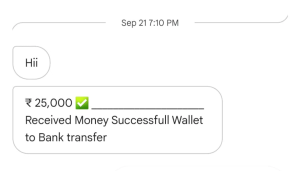

Immediate Payment Service (IMPS): Enabling instant 24/7 interbank transfers, IMPS has significantly enhanced real-time payments. In December 2024, leading banks like the State Bank of India processed approximately 96.79 million IMPS transactions with an approval rate of 96.05%. NPCI

Bharat Bill Payment System (BBPS): Streamlining bill payments, BBPS offers interoperable and accessible services, simplifying the payment process for millions.

Impact on Digital Payment

NPCI’s initiatives have led to exponential growth in digital transactions:

UPI transactions surged from 92 crore in FY 2017-18 to 13,116 crore in FY 2023-24, reflecting its widespread adoption.

Financial Services

In the first five months of FY 2024-25, UPI transaction volume reached 8,659 crore, indicating sustained growth.

Press Information Bureau

NPCI reported a 37% year-on-year surplus growth to ₹1,134 crore in FY 2024, underscoring its financial robustness.

Medianama

Role of Fintech Companies

Fintech companies like 86400 have been instrumental in this digital revolution. By leveraging NPCI’s infrastructure, they offer innovative solutions that enhance user experience and expand the reach of digital payments across the nation.

NPCI’s relentless pursuit of innovation has transformed India’s payment ecosystem, making digital transactions an integral part of daily life. As we move forward, the collaboration between NPCI and fintech companies will continue to drive financial inclusion, economic growth, and a truly digital India.